THE Provincial Government of Bali has asked the central government to be willing to provide working capital soft loan funds for tourism sector entrepreneurs in this area worth IDR9.5 trillion, although currently 9 regencies and cities have received grants of IDR1.2 trillion.

According to Bali Governor Koster said the request was submitted because he felt that assistance through existing policies had not been able to answer the challenges of the tourism industry on the Island of the Gods. There is still a need for a spatial policy in an effort to revive the economy of this region with a population of 4.5 million.

“The tourism sector has an important role in the economy of Indonesia and Bali. In 2019, the contribution of tourism to Indonesia’s gross domestic product (GDP) reached 5.5%. Of the total national tourism foreign exchange earnings, 55.36% was contributed by Bali,” he said.

According to him, the IDR9.5 trillion fund was only 7% of Bali’s total foreign exchange contribution when calculated using the rupiah value against the US dollar of IDR14,500 per share. The current economic condition of Bali is very much supported by tourism, so the impact of the pandemic has caused economic growth to contract by minus 9.8% in the second quarter. The decline in tourist arrivals has resulted in the closure of hotels, restaurants and other tourism supporting companies.

Koster revealed that the value of foreign exchange earnings due to COVID-19 is estimated at IDR108 trillion per year. The tourism sector has an important role in the economy of Indonesia and Bali.

Therefore, in the application letter submitted to the president, Koster suggested that the proposed soft loan uses the national economic recovery (PEN) scheme for corporations by revising Financial Services Authority Regulation (POJK) 11 of 2020.

In order not to burden tourism entrepreneurs, the maximum loan term is 10 years with a grace period of 2 years. In addition, low or no interest rates and allocation of soft loans to entrepreneurs based on their contribution to Hotel and Restaurant Tax (PHR), State Income Tax (VAT) and entertainment tax in 2019.

It is hoped that this soft and corporate loan will be beneficial for entrepreneurs to survive the pandemic and to increase Bali’s competitiveness after COVID-19. It is hoped that this mechanism will also have a positive impact on efforts to recover the economy in Bali due to the large multiplier impact on the tourism sector. This mechanism is believed to be able to support efforts to restore national tourism.

Meanwhile, according to the Head of the BI Bali Representative Office, Trisno Nugroho, if the center realizes it will at least help entrepreneurs survive and be able to maintain a better business climate and be able to compete with tourist destinations in other countries. The injection of these funds, if realized, can also complement the PEN that has been disbursed.

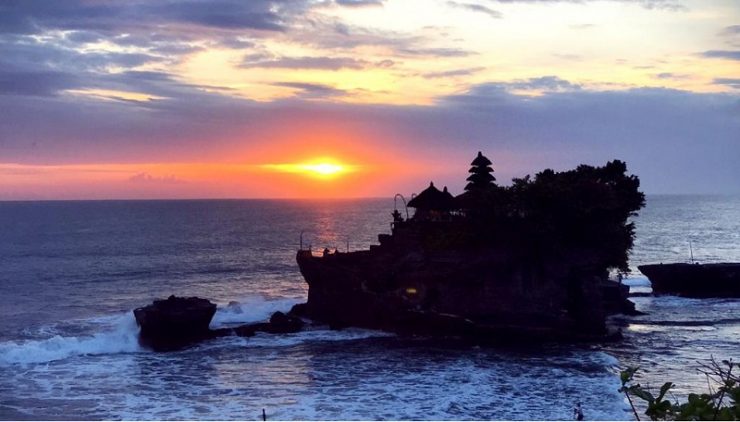

He emphasized that Bali is the storefront for Indonesian tourism because most of the foreign tourists to Indonesia stop by Bali. However, at this time, Bali is badly affected because tourism as the locomotive of regional economic growth is not running. [bisnis.com/photo special]